Platinum MEV

Platinum MEV is a digital asset manager that focuses on finding and extracting value from nascent DeFi markets. Their strategies follow a mandate of stable asset exposure and is supported by well-defined benchmarks. Operations mainly consist of statistical arbitrage and liquidity provisioning governed by a set of public protocals. These protocols are selected to reflect internal risk management rules, fit regulatory criteria, and answer investor needs.

Platinum MEV Capital's investment policy and approach are targeted at extractable value. The asset manager aims to achieve consistent returns for investors by operating in a high liquidity environment and under the strongest security framework.

Statistical arbitrage

Arbitration between DEXes is the classic and most popular way to extract MEV. We work on several networks, ensuring the alignment of prices on different DEXs.

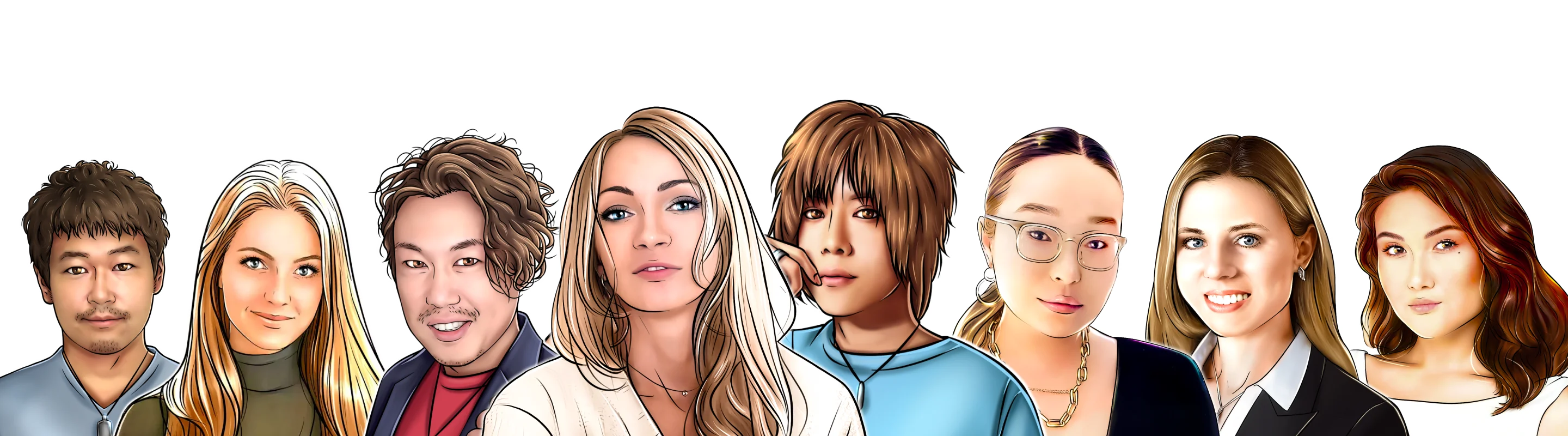

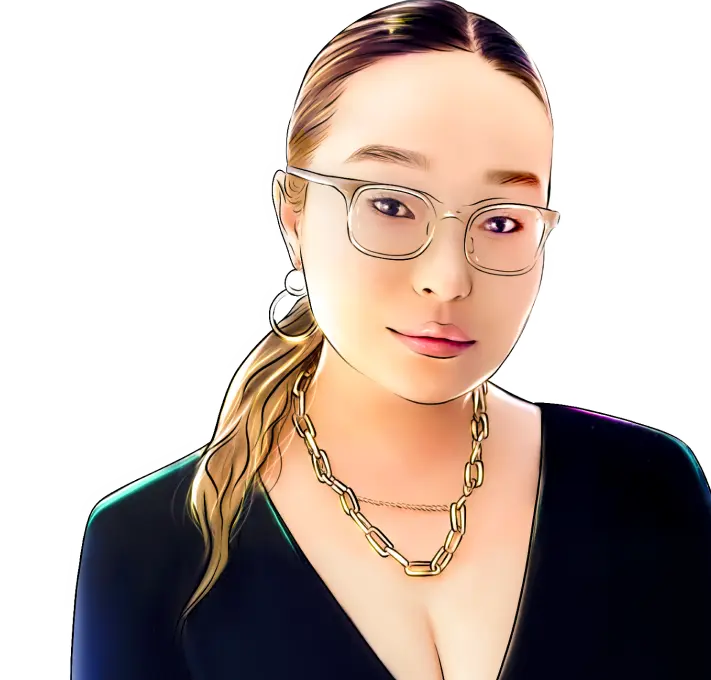

Nataly Lee

Position-Profit generator Education-Harvard University Employment-Platinum.MEV, Ex-Facebook

Liquidation Calls

We participate in the liquidation of large positions on landing protocols.

Meko Mamyth

Position-First impression director Education-Imperial College London Employment-Platinum.MEV, Ex-Stripe

Liquidity Position

We track large transactions and immediately send tokens to the liquidity pool in order to get the maximum commission for the exchange.

Xenia Drobyshevska

Position-Fairy Godmother (COO) Education-MIT Employment-Platinum.MEV, Ex-Apple

Pool Imbalance

We keep records of funds in the pool of client tokens and, if necessary, equalize the ratio of funds if the assets are on different networks.

Purr Generator

Carry Trading

We carry out dex-marketmaking for our clients. We carefully manage our clients` positions, to get them the maximum benefit.

Alena Kant

Position-Keeper of the keys Education-MIT Employment-Platinum.MEV, Ex-Apple

Maximizing capital efficiency in Decentralized Finance

Smart contract interoperability enables operators to process automated transactions over multiple protocols without friction. DeFi infrastructure allows for a high turnover of assets, which increases the compounding effects from cash-and-carry opportunities.

Aiza Thompson

Position-Engineer of Happines Education-California Institute of Technology Employment-Platinum.MEV, Ex-Booking

Arbitrage and MEV

Cross DEX Arbitrage Strategies. Designed to exploit market inefficiencies and price discrepancies among different DEXs.

Nguyen D

Position-Keeper of the keys Education-MIT Employment-Platinum.MEV, Ex-Apple

Liquidations MEV

Strategies developed by acting as an agnostic actor, checking liquidation levels, profiting from price discounts and maintaining price stability in the DeFi lending market.

Zhiyuan Chen

Position-Capital Shark Education-National University of Singapore (NUS) Employment-Platinum.Mev, Ex-Binance

Market Making for FT

We provide market-making services across the top decentralized exchanges, developing the best routing possible with fluid order processing. (Order Book and AMM).

I-Chan Huang

Position-Finance God Education-Peking University Employment-Platinum.Mev, Ex-Bain

Market Making for NFTs

Supporting price stability with tight liquidity

Michael Ma

Position-Risk Predictor Education-Tsinghua University Employment-Platinum.Mev,Ex-Industrial and Commercial Bank of China

DeFi Strategies

Designed to extract maximum value from protocols’ tokenomic models.

Jia Peng

Position-Brand Decorator Education-The University of Hong Kong Employment-Platinum.MEV, Ex-Alibaba

Long Strategies

Designed to outperform traditional benchmarks by tilting the composition.

Michael Tong

Position-KOL guy Education-The University of Hong Kong Employment-Platinum.MEV, Ex-Binance

Yield enhanced risk premia

Long and Short. Designed to provide a positive return profile with low traditional asset correlation.

Stefan Shen

Position-Opportunity analyst Education-The University of Hong Kong Employment-Platinum.MEV, Ex-Tencent

Tail Hedging

Effective way to limit losses in adverse markets. It enables our Fund to stick with long-term positions through a bearish market. The Platinum Fund approach favors cost-effective solutions that balance protection against dominant risks in a portfolio with long-run returns.

Tomas Wang

Position-Value Creator Education-National University of Singapore Employment - Platinum.MEV, Ex-Apple